How Mergers and Acquisitions Advisors Can Drive Your Company Success

Mergers and purchases advisors are indispensable to navigating the intricacies of corporate deals, offering vital expertise that can dramatically improve company end results. Recognizing how these advisors can affect your company's trajectory is vital; the ramifications of their participation might improve your organization landscape in unexpected methods.

Recognizing M&A Advisors' Role

Mergers and purchases (M&A) consultants play a vital role in helping with intricate organization transactions, directing customers with the detailed procedure of buying, selling, or merging business. Their know-how incorporates a wide range of activities, including monetary analysis, appraisal, negotiation, and due diligence. M&A consultants work as middlemans, leveraging their market understanding and network to determine prospective purchasers or vendors, consequently improving the possibilities of a successful deal.

The primary responsibility of M&An advisors is to ensure that their clients receive optimum worth from the purchase - Mergers And Acquisitions Advisors. They carry out complete marketing research and economic evaluations to establish an extensive understanding of the client's business and its placement within the sector. This enables them to craft tailored strategies that straighten with the customer's goals

Along with providing critical understandings, M&A consultants help with negotiations in between celebrations, guaranteeing that communication continues to be clear and effective. They also help in navigating governing demands and dealing with potential difficulties that may emerge throughout the transaction. Inevitably, the function of M&An advisors is to decrease dangers and take full advantage of opportunities, permitting services to achieve their critical goals properly and efficiently.

Identifying Strategic Opportunities

In the vibrant landscape of company, recognizing calculated possibilities is necessary for companies seeking development and competitive benefit. Mergers and acquisitions (M&A) consultants play a crucial function in this procedure by leveraging their competence to determine potential targets that line up with a company's calculated goals. They carry out thorough market analyses to reveal trends, evaluate affordable positioning, and assess prospective harmonies that can be realized through debt consolidation.

M&An advisors utilize their substantial networks and sector understandings to identify business that not just match the acquirer's toughness but also fill up spaces in capacities or market visibility. This involves evaluating monetary efficiency, social fit, and functional performances, ensuring that the prospective opportunity is practical and beneficial.

Additionally, the recognition of critical possibilities is not limited to acquisition targets; it also includes divestitures, joint ventures, and calculated collaborations. By reviewing these opportunities, M&An experts help firms enhance their profiles and concentrate on core expertises, inevitably driving lasting development. By doing this, the aggressive recognition of calculated chances ends up being a foundation of efficient service method, allowing companies to navigate market intricacies and take helpful positions.

Improving the Transaction Refine

First, a well-defined roadmap is important. Advisors establish clear timelines and milestones, assisting in a smoother process. By collaborating due persistance efforts, they lessen redundancies and make sure that all needed info is gathered and evaluated immediately.

Furthermore, efficient interaction is vital. Advisors serve as the main liaison between customers and vendors, making sure that assumptions are lined up and that potential misconceptions are promptly attended to. This positive method fosters openness and develops count on, which is important for a successful purchase.

Additionally, leveraging innovation can considerably enhance the purchase process. Advisors utilize sophisticated information rooms and project management tools to streamline information, permitting less complicated gain access to and real-time updates.

(Transaction Advisory Services)Essentially, by improving the deal process, mergers and acquisitions advisors not only accelerate the trip to conclusion yet additionally aid minimize threats and maximize end results for all stakeholders involved.

Assessment and Arrangement Know-how

(Pre-Acquisition Due Diligence)Appraisal and arrangement proficiency are crucial parts in the mergings and acquisitions landscape, as they directly influence the success of any type of purchase. Exact assessment is essential for identifying a fair rate that shows the target firm's real well worth, considering assets, liabilities, market conditions, and future growth potential. Advisors employ various appraisal methods, such as reduced capital evaluation and similar business evaluation, to supply a detailed analysis.

Experienced consultants use approaches such as establishing clear interaction, promoting partnerships, and recognizing the motivations of each celebration to navigate complicated conversations. They likewise anticipate possible objections and prepare counterarguments to preserve energy throughout the negotiation procedure.

Ultimately, the mix of assessment precision and skilled negotiation strategies empowers services to make informed choices, secure desirable terms, and accomplish their tactical purposes. In a landscape where even small inconsistencies can result in considerable monetary consequences, the worth of specialist assistance in these areas can not be overstated.

Post-Merger Assimilation Support

Successful mergings and purchases expand far beyond valuation and arrangement, as the real difficulty often lies in the assimilation of the recently combined entities. Reliable post-merger assimilation (PMI) is crucial to recognizing the anticipated harmonies and making sure that the merger achieves its critical purposes. Advisors play an important role in this phase by home offering structured support and experience.

Among the main concentrates of PMI is lining up the company societies of the merging organizations. This alignment is vital to promote employee engagement and maintain performance, as differing cultures can bring about friction and disengagement. Advisors assistance assist in communication techniques that advertise transparency and inclusivity, thus easing the transition.

Furthermore, functional combination must be diligently prepared and carried out. This includes settling systems, procedures, and resources while reducing disturbances. Advisors aid in identifying ideal methods and streamlining procedures to develop efficiency.

Lastly, recurring performance tracking is essential to evaluate the success of the integration. Advisors can execute key efficiency signs (KPIs) to track progression and make essential changes. By prioritizing efficient post-merger combination support, organizations can enhance their possibilities of long-lasting success and take full advantage of the value generated from the merging.

Final Thought

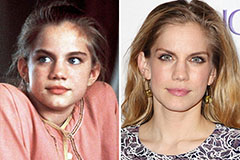

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now!